Last week, we reported on the financial reasons purchasing a home in today’s market makes sense. The Joint Center for Housing Studies at Harvard University performs a study every year surveying participants for the reasons that American’s feel are most important in regards to homeownership.

The top 4 reasons to own a home cited by respondents were not financial.

1. It means having a good place to raise children & provide them with a good education

From the best neighborhoods to the best school districts, even those without children at the time of purchasing their home, may have this in the back of their mind as a major reason for choosing the location of the home that they purchase.

2. You have a physical structure where you & your family feel safe

It is no surprise that having a place to call home with all that means in comfort and security is the #2 reason.

3. It allows you to have more space for your family

Whether your family is expanding, or an older family member is moving in, having a home that fits your needs is a close third on the list.

4. It gives you control over what you do with your living space, like renovations and updates

Looking to actually try one of those complicated wall treatments that you saw on Pinterest? Want to finally adopt that puppy or kitten you’ve seen online 100 times? Who’s to say that you can’t in your own home?

The 5th reason on the list, is the #1 financial reason to buy a home as seen by respondents:

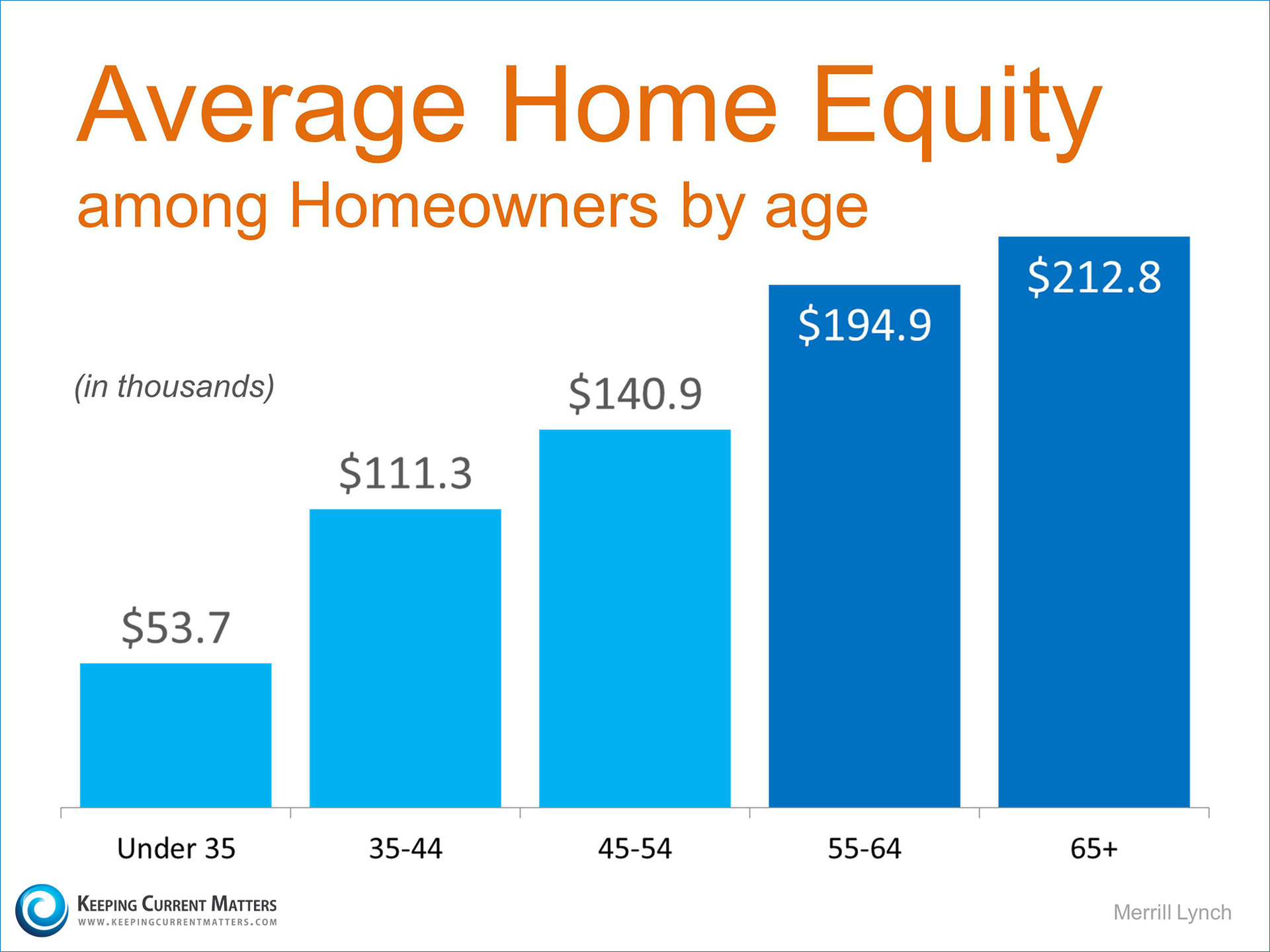

5. Owning a home is a good way to build up wealth that can be passed along to my family

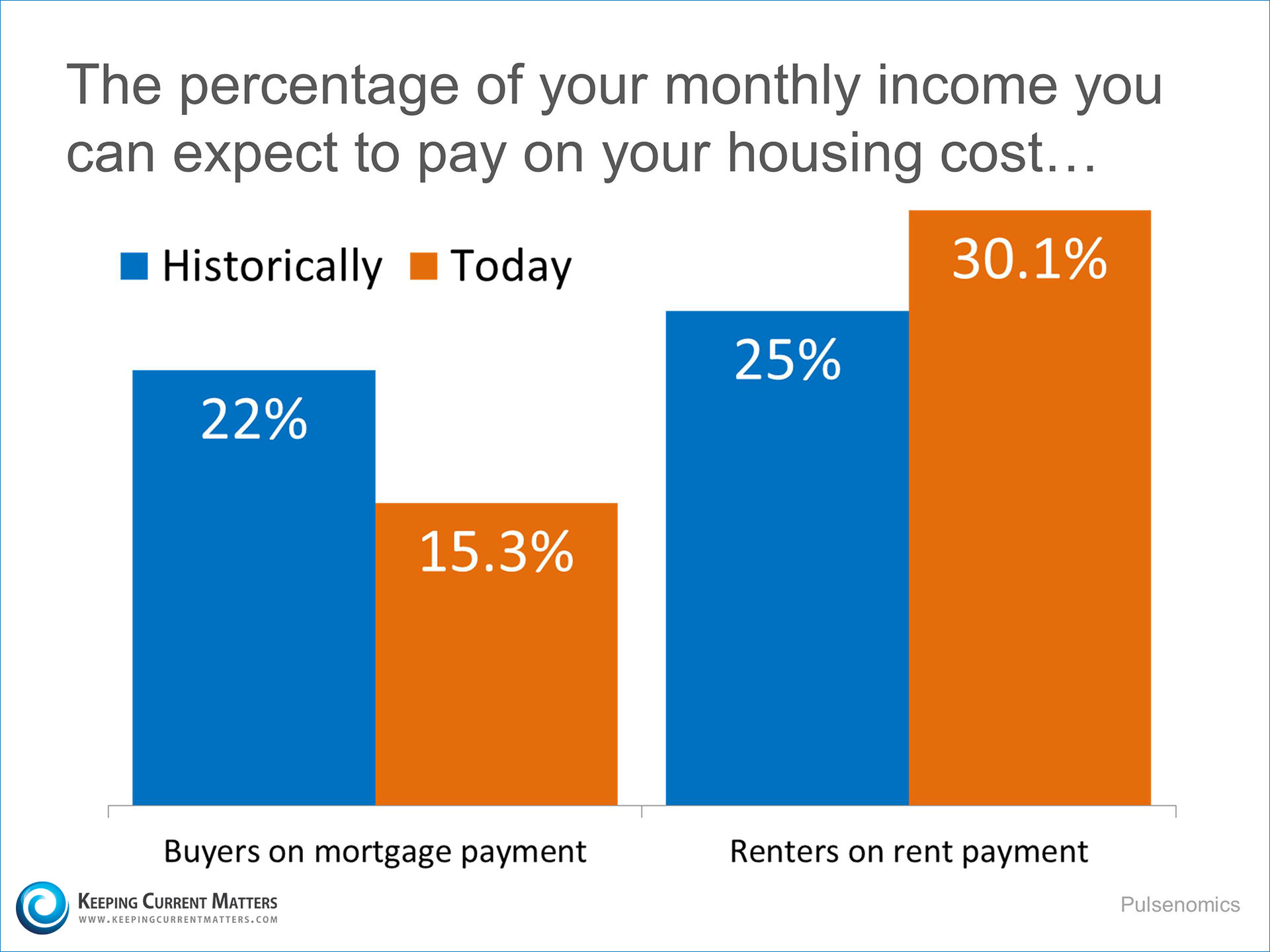

Either way you are paying a mortgage. Why not lock in your housing expense now with an investment that will build equity that you can borrow against in the future?

Bottom Line

Whether you are a first time homebuyer or a move-up buyer who wants to start a new chapter in their life, now is a great time to reflect on the intangible factors that make a house a home.

![The Difference A Year Can Make [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/04/Calendar-Blue.jpg)

![The Difference A Year Can Make [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/04/Payment-Difference-KCM.jpg)